Master Financial Statement Adjustments: Transform Your Accounting Skills

Transform your approach to financial reporting with our comprehensive, step-by-step system designed for accounting students at all levels. Gain confidence in balance day adjustments and year-end reporting through our proven logic-first methodology.

Why Financial Statement Adjustments Matter

Of accounting errors stem from poor financial statement adjustments

Required for true financial position assessment

For professional accounting certification

Financial statement adjustments are the backbone of accurate reporting, providing crucial insights into a company’s true financial position and ensuring compliance with accounting standards. Mastering this skill is essential for career advancement in accounting.

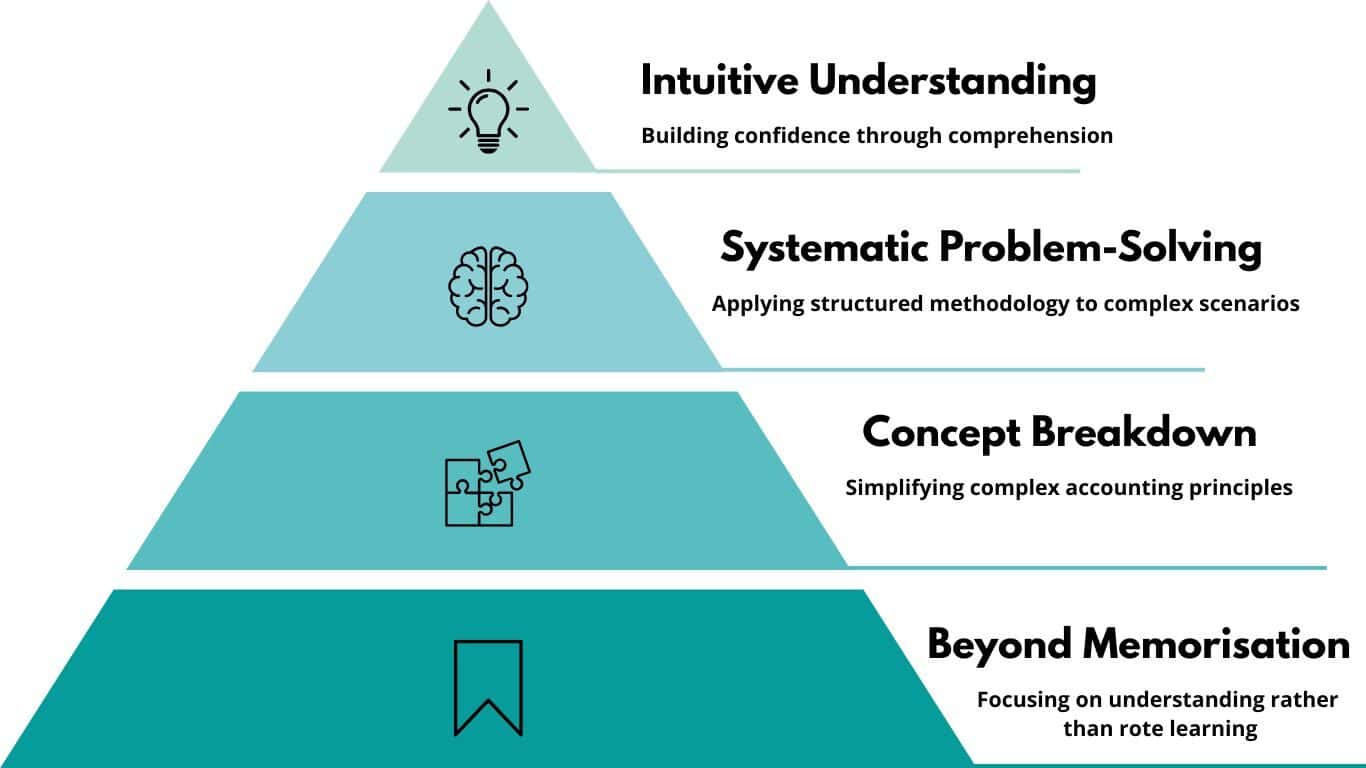

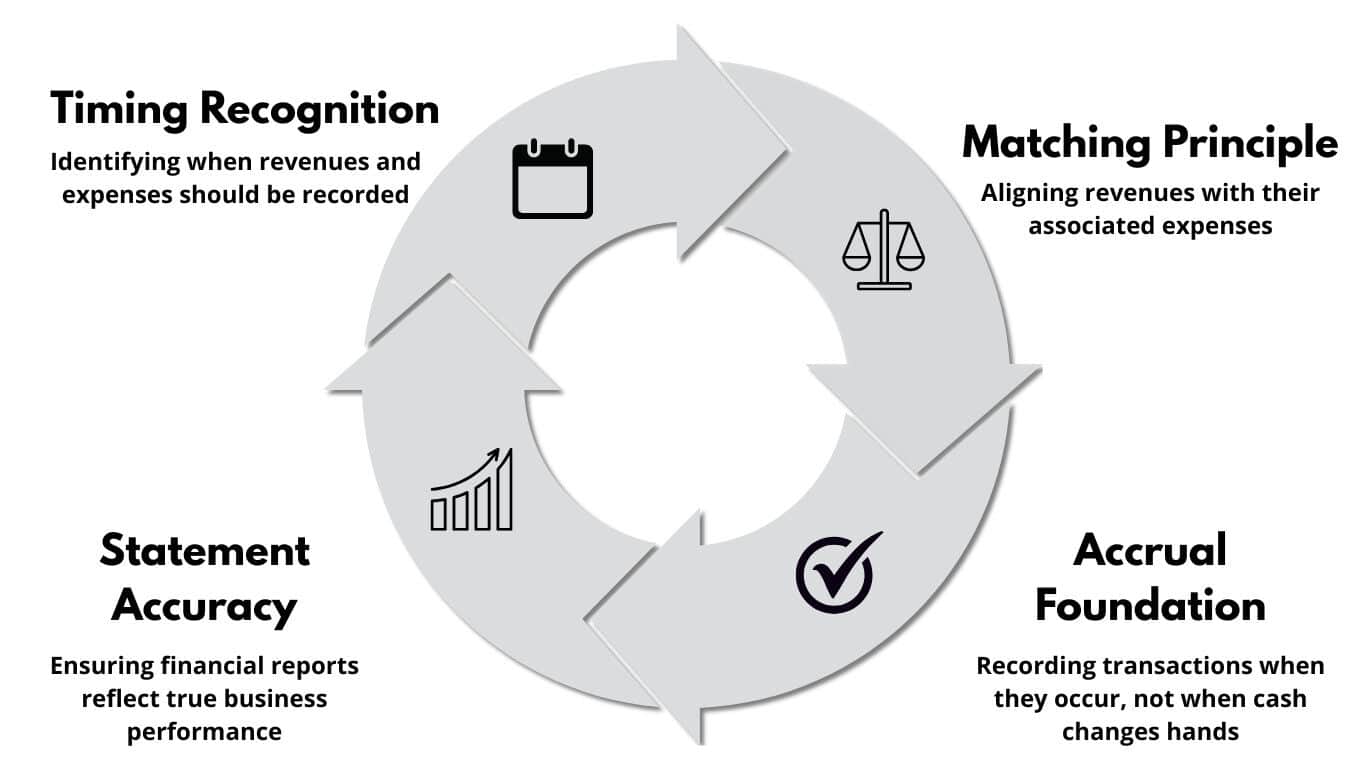

The Logic-First Approach

Understanding Balance Day Adjustments

Mastering Accruals and Prepayments

Accrued Revenues

– Interest earned on investments

– Services performed but not yet billed

– Rent receivable from tenants

Accrued Expenses

– Salary and wages payable

– Interest due on loans

– Utility bills pending payment

Prepaid Expenses

– Insurance premiums

– Rent paid in advance

– Prepaid subscriptions

Depreciation Demystified

Select Method

Choose straight-line, declining balance, or units of production based on asset characteristics

Calculate Reduction

Determine periodic expense based on asset cost, useful life, and residual value

Record Entries

Document depreciation expense and accumulated depreciation in financial statements

Regular Review

Periodically reassess useful life and method to ensure accurate representation

ADD AN OVERLINE

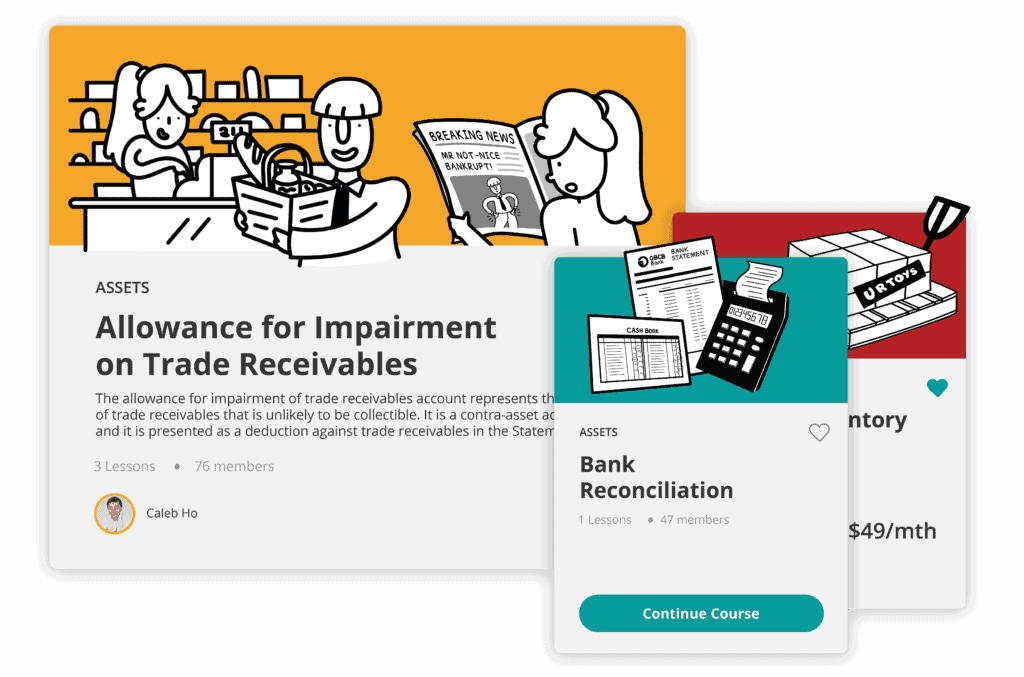

Master Allowance for Impairment with HUAL

Hypothesis (H)

The starting balance of your Allowance for Impairment before any current period adjustments.

Adjustment (A)

The figure recorded in the Statement of Financial Performance (as impairment loss or reversal) to adjust the allowance to the desired level.

Used (U)

The amount of actual bad debts written off during the accounting period, reducing the allowance.

Left (L)

The required ending balance of the Allowance for Impairment, shown in the Statement of Financial Position.

This logic-first approach eliminates guesswork and ensures you understand how each adjustment impacts your financial statements. Remember, every adjustment involves a double entry.

Practical Workshops and Case Studies

Interactive Learning

Work through complex financial scenarios in collaborative sessions designed to strengthen your adjustment skills through practical application

Industry-Specific Challenges

Tackle specialized adjustment requirements across various business sectors, from manufacturing to service industries and non-profit organizations.

Step-by-Step Problem Solving

Master systematic approaches to identify, analyze, and correctly implement all necessary period-end adjustments with confidence

Tools and Resources

Access to industry-standard accounting programs with special focus on adjustment features and reporting capabilities.

Comprehensive worksheets, templates, and guides specifically designed to reinforce adjustment concepts through application.

Online modules, video tutorials, and self-assessment tools to strengthen your understanding at your own pace.

Your Path to Accounting Mastery

Foundation Building

Master core concepts through structured learning

Skill Application

Practice with increasingly complex scenarios

Comprehensive Mastery

Develop confidence across all adjustment types

Professional Excellence

Apply advanced techniques in real-world contexts

Your journey to accounting mastery is ongoing. Continue building on your foundation with regular practice, stay current with accounting standards, and approach each financial challenge with the systematic methodology you’ve developed. The confidence you gain will transform not just your academic success, but your professional potential.

Level Up Your Accounting Skills with Our Master Financial Statements Adjustment Course!

Mastering financial statement adjustments is crucial for making accurate financial decisions, ensuring compliance, and boosting your career in accounting or finance. Equip yourself with the essential knowledge and practical skills to handle complex adjustments confidently.

Register your interest now to secure your spot in our upcoming course! Share your contact details, and we’ll notify you as soon as the next class is scheduled. Don’t miss this opportunity to enhance your expertis!