Time Left:

00

:

00 :

00

HRS

MIN

SEC

Time Spent: %%TIMESPENT%%

Time expired. Sorry, you will not be able to continue with this quiz. Please opt-in to see the result.

SEC

HRS

MIN

SEC

SEC

Total Time

[SQBTimeSpent]

0

HRS

0

MIN

0

SEC

11 Allowance for impairment of trade receivables

This quiz is designed to help students revise accounting principles related to trade receivables. It covers topics such as impairment losses, allowances for impairment of trade receivables, and the impact of customer bankruptcies on financial statements. By focusing on concepts like matching expenses with revenues, recognizing impairment losses, and calculating net trade receivables accurately, this quiz provides a valuable opportunity for students to test their understanding and prepare for assessments.

Continue

1%

A) To decrease revenue

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) To reduce customer base

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) To increase revenue

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) None of the above

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

Which of the following accounting principles supports the adjustments made for customers suspected unable to pay debts?

A) Matching

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Materiality

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Consistency

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Objectivity

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

A) Trade receivables balance

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Economic outlook

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Credit terms and cash discount

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Existing customers' favorite color

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

A) Uncollectible debts in the future

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Immediate future collections

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Trade discounts calculation

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Historical revenue data

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

How is a decrease in the allowance for impairment of trade receivables treated in the Statement of Financial Performance?

A) Treated as an increase in revenue

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Treated as a reduction against expenses

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Treated as an increase in expense

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Ignored in financial statements

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

A) trading portion of the Statement of Financial Performance

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) profit and loss portion of the Statement of Financial Performance

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) current assets section of the Statement of Financial Position

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) current liabilities section of the Statement of Financial Position

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

A) trading portion of the Statement of Financial Performance

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) profit and loss portion of the Statement of Financial Performance

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) current assets section of the Statement of Financial Position

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) current liabilities section of the Statement of Financial Position

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

A) trade receivables plus impairment loss on trade receivables

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) trade receivables plus allowance for impairment of trade receivables

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) trade receivables less allowance for impairment of trade receivables

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) trade receivables less impairment loss on trade receivables

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

On 31 December 2025, the firm decided to create an allowance for impairment of trade receivables. What are the accounting entries?

A) Dr Impairment loss on trade receivables; Cr Trade receivables.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Dr Allowance on impairment loss on trade receivables; Cr Trade receivables.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Dr Impairment loss on trade receivables; Cr Allowance for impairment loss on trade receivables.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Dr Allowance for impairment loss on trade receivables; Cr Impairment loss on trade receivables.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

On 31 May 2025, debtor John who owed the firm $450 went bankrupt. No allowance or impairment on the amount was made in the previous year. What are the accounting entries when the firm decided to write the debt off?

A) Dr Impairment loss on trade receivables; Cr Trade receivables - John .

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Dr Allowance on impairment loss on trade receivables; Cr Trade receivables -John .

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Dr Impairment loss on trade receivables; Cr Allowance for impairment loss on trade receivables.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Dr Allowance for impairment loss on trade receivables; Cr Impairment loss on trade receivables.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

An allowance for impairment of trade receivables amounting to $2000 was already made in the books of Xing Ying. Subsequently a customer Bing Chen who owes the business $900 declared bankruptcy and was only able to pay 40 cents for every dollar it owed. Which of the following reflects the correct entries that should be recorded in the books of Xing Ying?

A) Dr Cash at bank account 360 Cr Trade receivables 360 Dr Allowance for impairment of trade receivables 540; Cr Impairment loss on trade receivables 540

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Dr Cash at Bank 360; Cr Trade receivables 360 Dr Allowance for impairment of trade receivables 540; Cr Trade receivables 540

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Dr Cash at Bank 360; Cr Trade receivables 360 Dr Impairment of trade receivables 360; Cr Allowance for Impairment of trade receivables 360

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Dr Trade receivable 540; Cr Cash at bank 540 Dr Allowance for impairment of trade receivables 360; Cr Trade receivables 360

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

During the year ended 31 December 2025, debtor Ali who owed $300 was declared bankrupt. Allowance on impairment on debt due from Ali was made on 31 December 2024. What are the accounting entries when the firm decided to write off the debt?

A) Dr Impairment loss on trade receivables; Cr Trade receivables - Ali.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) Dr Allowance on impairment loss on trade receivables; Cr Trade receivables -Ali .

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) Dr Impairment loss on trade receivables; Cr Allowance for impairment loss on trade receivable

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) Dr Allowance for impairment loss on trade receivables; Cr Impairment loss on trade receivable.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

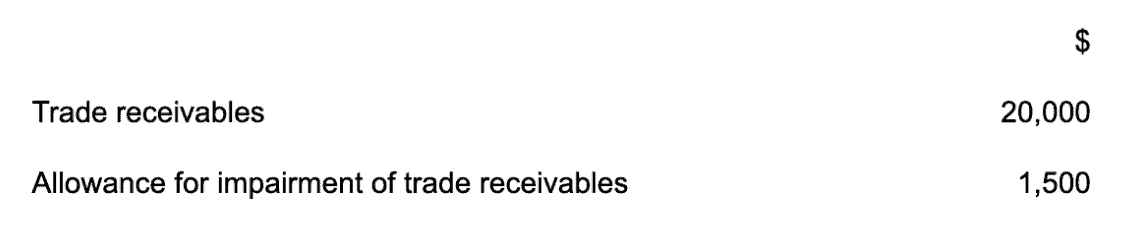

The following is an extract from the trial balance of Alco Trading on 31 December 2024:

The allowance is to be maintained at 5% of debtors

How would the impairment loss on trade receivable be shown in the statement of financial performance?

a) an increase in expense of $500

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

b) an increase in expense of $1,000

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

c) an increase of income of $500

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

d) a decrease in expense of $500

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

Tarzan’s trade receivable balance at the end of the year were $75,600, including $2 400 owed by Manson. This debt is now written off as bad. It is then decided to set up an allowance for impairment of trade receivables of 2% of the trade receivables at the end of the year.

What will be the net trade receivables figure in the Statement of Financial Position?

A) $71 688

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

B) $71 736

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

C) $74 088

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

D) $74 136

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

The trial balance of AZ trading showed the following:

The allowance is to be maintained at 5% of trade receivables.

How would the allowance be shown in the statement of financial position?

(a) A deduction from trade receivables of $500.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

(b) A deduction from trade receivables of $875.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

(c) A deduction from trade receivables of $1,000.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned Tags

(d) A deduction from trade receivables of $2,500.

A text area will be displayed in the frontend when users select this answer.

Add RecommendationAdd TagsView All Assigned TagsContinue

%%QUESTIONANSWERS%%

Skip Opt-in

Almost there...

Where can we email you the results? Please enter details below.

Retake

YOUR TOTAL POINTS

0